MNKD had a roller coaster day as they stormed right out of the gate with highs of 5.75 ( Up 9% ) before closing at 4.83 ( down 7%). This could be attributed to the fact that good news came out of MNKD during the early stages of the day before a semi- negative briefing sucked the air right out of MNKD ( closed DOWN 7%.

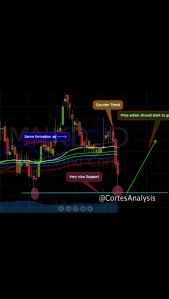

Short Term Tech Analysis on MNKD. Done by @cortesanalysis

My only thoughts are that Afrezza is designed for Type 2 & Type 1 diabetes. Type 2 diabetes is the most common among diabetics. Based on the results of MNKD’s briefing it appears that the FDA will approve Afrezza for Type 2 but not type 1. Which brings up the question how critical is Type 1’s approval to MNKD’s share holders? After all Type 1 diabetes only AFFECTS 10% of diabetics. In my opinion the approval for type 1 is not as critical as the approval for type 2. Therefore if Afreeza gets approved for Type 2 I can see a growth of 20-50% increase within the stock. However if Type 1 & Type 2 both get approved look to see gains of 100% +.

Note* 3 Analysts @ Hereitfirst have a significant amount of money in Mannkind. For those who are interested in playing the AdCom for MNKD please beware this is a high risk high reward type of investment. To see what happens when big news comes out of bio-pharms take a look at ICPT $70-$490 , OXBT $1-15, CHTP $2- $6.15 . To see the worse case scenario for a bio pharm Take a look at CNDO $8 – 1.25.

*Article Written By Jeff Eiseman of Seeking Alpha

The FDA AdCom panel will convene on Tuesday to review Afrezza, the inhaled insulin developed by MannKind (MNKD). The 249-page document released this morning for Tuesday’s briefing panel has been distorted by early press releases. My explanations are brief because I want to get this published while there is still trading time.

There is generally good news for MannKind, but there are also issues that might prevent Afrezza from being approved for Type 1 diabetes, which represents less that 10 percent of the market. The key highlights are:

1. There are no cardiovascular or cancer-related concerns flagged.

2. The information about weight gain in the Type 2 trials was not seen as important.

3. A pulmonary committee did not recommend for or against pooling the MedTone FEV data with the Gen2 FEV data. It said that this was an issue for the AdCom to discuss. Given that there was no apparent clinical significance for at least most of those that had a decreased FEV result, that any label would likely advise testing after the first six months and then annually, and that if there was a significant drop in FEV data revealed by such testing, patients could always stop taking Afrezza, I do not expect that this will prevent approval.

4. A similar statement can be made about coughing. Coughing was one of the primary reasons some subjects dropped out, but obviously those who are sufficiently bothered by coughing (for example, when it doesn’t go away after a couple of weeks or is more severe than a mild annoyance) can stop. Coughing is not a basis for recommending against approval.

5. There was some concern about the dropout rate for subjects taking Afrezza, especially in the Type 1 study. As long as the main endpoint is considered to be A1c, then panel members may not consider Afrezza to be non-inferior, given that in the most recent study it was barely non-inferior (without taking into account the dropouts which might have reversed the conclusion). However, eventually the FDA will recognize the importance of taking into account the size of blood sugar swings or even just the size of blood sugar surges and recognize that Afrezza is actually superior on the metrics that correlate with long-term health and survivability.

6. There was also a concern that there is not a linear relationship between the dose that Afrezza patients take and the amount that blood sugar levels are reduced. This is not a reason to recommend against approval, but it means that MannKind has to figure out how to give better advice for patients who require a lot of prandial insulin. There may be an upper limit. One solution for those requiring high amounts is, for Type 2, to add another oral medication or to add or increase the amount of basal insulin. The latter approach seem to have worked in the trials for those with Type 1 diabetes, although the FDA commenter drew a different conclusion. It is too early to tell whether there is an upper limit for Afrezza doses, although if there is, it is a limit based on efficacy rather than safety.

7. There is not the same concern about the results for those who have Type 2 diabetes. While at least one reviewer commented that the size of the advantage over the placebo was modest in terms of reducing A1c, it nevertheless met the endpoints. Again, doctors and insurance companies will care more about slowing down or preventing long-term complications and that is where the size of blood sugar surges and wings matter, and why Afrezza will do well after approval.

To View The Original Article Click here

Once again this article was written by Jeff Eiseman of Seeking Alpha.

Cant lie I’m nervous about this stock

me too

Pingback: Stock Picks for 3-31 !!! | HEREITFIRST STOCK MARKET MILLIONAIRES

MNKD will be .85 or $6.55 on Tuesday. Place your bet. AMBS under a dime is a much safer investment.

i would say more like 9-10$

with a bottom of 1-2$

Pingback: Market Recap for 3-31 Picks Stock Picks for 4-1 | HEREITFIRST STOCK MARKET MILLIONAIRES